Open Market Operations

Open market operations -- the purchase and sale of U.S. Treasury and federal agency securities -- are the Federal Reserve's principal tool for implementing monetary policy. The short-term objective for open market operations can be a desired quantity of reserves or a desired price (the federal funds rate). The federal funds rate is the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight.

Tax Day (April 15) is about Paying the Fed

The result of open market operations (buying and selling government securities) has the effect of expanding or contracting the amount of money that is available to the banking system. Purchases inject money into the banking system and stimulate growth while sales of securities have the opposite effect.

How do Open Market Operations work in practice?

(1) Government Debt

The federal government adds ink to paper, creates impressive designs around the edges and calls it a bond or Treasury note. It is merely a promise to pay a specified sum at a specified interest on a specified date. This debt becomes the foundation for almost the entire nation's money supply. In reality, the government has created cash, but it doesn't you look like cash. To convert these IOUs into paper bills and checkbook money is the function of the Federal Reserve. To bring about that transformation, the bond is given to the Fed where it is then classified as a..

Federal Reserve System

(2) Securities Asset

An instrument of government debt is considered an asset because it is assumed the government will keep its promise to pay. This is based upon its ability to obtain whatever money it needs through taxation. Thus, the strength of this asset is the power to take back that which it gives. So the Federal Reserve now has an "asset" which can be used to offset a liability. It then creates this liability by adding ink to yet another piece of paper and exchanging that with the government in return for the asset. That second piece of paper is a ..

(3) Federal Reserve Check

There is no money in any account to cover this check. Anyone else doing that would be sent to prison. It is legal for the Fed, however, because Congress wants the money, adn this is the easiest way to get it (To raise taxes would be political suicide; to depend on the public to buy all the bonds would not be realistic, especially if interest rates are set artifically low; and to print very large quantities of currency would be obvious and controversial).

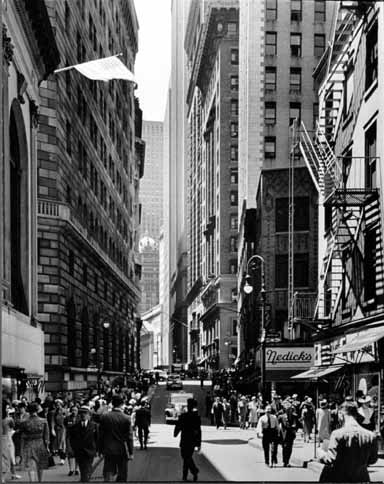

Federal Reserve Bank of New York (on left), circa 1920s

This way, the process is mysteriously wrapped up in the banking system. The end result, however, is the same as turning on government printing presses and simply manufacturing fiat money (money created by the order of government with nothing of tangible value backing it) to pay government expenses. Yet, in accounting terms, the books are said to be "balanced" because the liability of the money is offset by the "asset" of the IOU. The Federal Reserve Check received by the government then is endorsed and sent back to one of the Federal Reserve banks where it now becomes a ..

(4) Government Deposit

Once the Federal Reserve check has been deposited into the government's account, it is used to pay government expenses and, thus, is transformed into many..

(5) Government Checks

These checks become the means by which the first wave of fiat money floods into the economy. Recipients now deposit them into their own bank accounts where they become..

Federal Reserve Bank of Dallas

(6) Commercial Bank Deposits

Commercial bank deposits immediately take on a split personality. On the one hand, they are liabilities to the bank because they are owed back to the depositors. But, as long as they remain in the bank, they are also considered as assets because they are on hand. Once again, the books are balanced: the assets offset the liabilities. But the process does not stop there. Through the magic of fractional-reserve banking, the deposits are made to serve an additional and more lucrative purpose. To accomplish this, the on-hand deposits now become re-classified in the books and called

(7) Bank Reserves

Reserves for what? Are these for paying off depositors should they want to close out their accounts? No. That's the lowly function they served when they were classified as mere assets. Now that they have been given the name of "reserves", they become the magic wand to materialize even larger amounts of fiat money. This is where the real action is: at the level of the commercial banks. The banks are permitted by the Fed to hold as little as 10% of their deposits in "reserve." That means, if they receive deposits of $1 million from the first wave of money created by the Fed, they have $900,000 more they are required to keep on hand. In banker's language, that $900,000 is called ..

(8) Excess Reserves

The word "excess" is a tipoff that these so-called reserves have a special destiny. Now that they have been transmuted into an "excess", they are considered as available for lending. And so in the due course these excess reserves are converted into..

Federal Reserve Bank of Atlanta

(9) Bank Loans

So how can this money be loaned out when it is owned by the original depositors who are still free to write checks and spend it any time they wish? Isn't that a double claim against the same money? The answer is that, when the new loans are made, they are not made with the same money at all. They are made with brand new money created out of thin air for that purpose. The nation's money supply simply increases by 90% of the bank's deposits. Furthermore, this new money is far more interesting to the banks than the old. The old money, which they received from depositors, requires them to pay out interest or perform services for the privilege of using it. But with the new money, the banks collect interest, instead, which is not too bad considering it cost them nothing to make. Nor is that the end of the process. When this second wave of fiat money moves into the economy, it comes right back into the banking system, just as the first wave did, in the form of ..

(10) More Commercial Bank Deposits

The process now repeats but with slightly smaller numbers each time around. What was a "loan" on Friday comes back into the bank as a "deposit" on Monday. The deposit then is reclassified as a "reserve" and 90% of that becomes an "excess" reserve which, once again, is available for a new "loan." Thus, the $1 million of first wave fiat money gives birth to $900,000 in the second wave, which in turn gives birth to $810,000 in the third wave. It takes about 28 times through the revolving door of deposits becoming loans becoming deposits becoming loans until the process plays itself out to the maximum effect, which is

(11) Bank Fiat Money == Up to 9x the National Debt

The amount of fiat money created by the banking system is approximately 9x the amount of the original government debt which made the entire process possible. When the original debt itself is added to that figure, we finally have..

(12) Total Fiat Money == Up to 10x the National Debt

The total amount of fiat money created by the Federal Reserve and the commercial banks together is approximately 10x the amount of the underlying government debt. To the degree that this newly created money floods into the economy in excess of goods and services, it causes the purchasing power of all money, both old and new, to decline. Prices go up because the relative value of the money has gone down. The result is the same as if that purchasing power had been taken from us in taxes. The reality of this process, therefore, is that it is a

(13) Hidden Tax = Up to 10x the National Debt

Without realizing it, Americans have paid over the years, in addition to their federal income taxes and excise taxes, a completely hidden tax equal to many times the national debt! And that still is not the end of the process. Since our money supply is purely an arbitrary entity with nothing behind it except debt, its quantity can go down as well as up. When people are going deeper into debt, the nation's money supply expands and prices up go, but when they pay off their debts and refuse to renew, the money supply contracts and prices tumble. That is exactly what happens in times of economic or political uncertainty. This alteration between periods of expansion and contraction of the money supply is the underlying cause of..

(14) Booms, Busts and Depressions

Who benefits from all this? Certainly not the average citizen. The only beneficiaries are the political scientists in Congress who enjoy the effect of unlimited revenue to perpetuate their power, and the monetary scientists within the banking cartel called the Federal Reserve System who have been able to harness the American people, without their knowing it, to the yoke of modern feudalism.

For more information on this subject, please consult the excellent book The Creature from Jekyll Island, by G. Edward Griffin.